Docu Prep provides the mortgage industry with compliant, customizable closing documents, initial disclosures, and fulfillment through our flagship solution.

We’re recognized in the industry for our ability to customize and meet specific lender needs, and we’re backed by an industry leading compliance team and document guarantees.

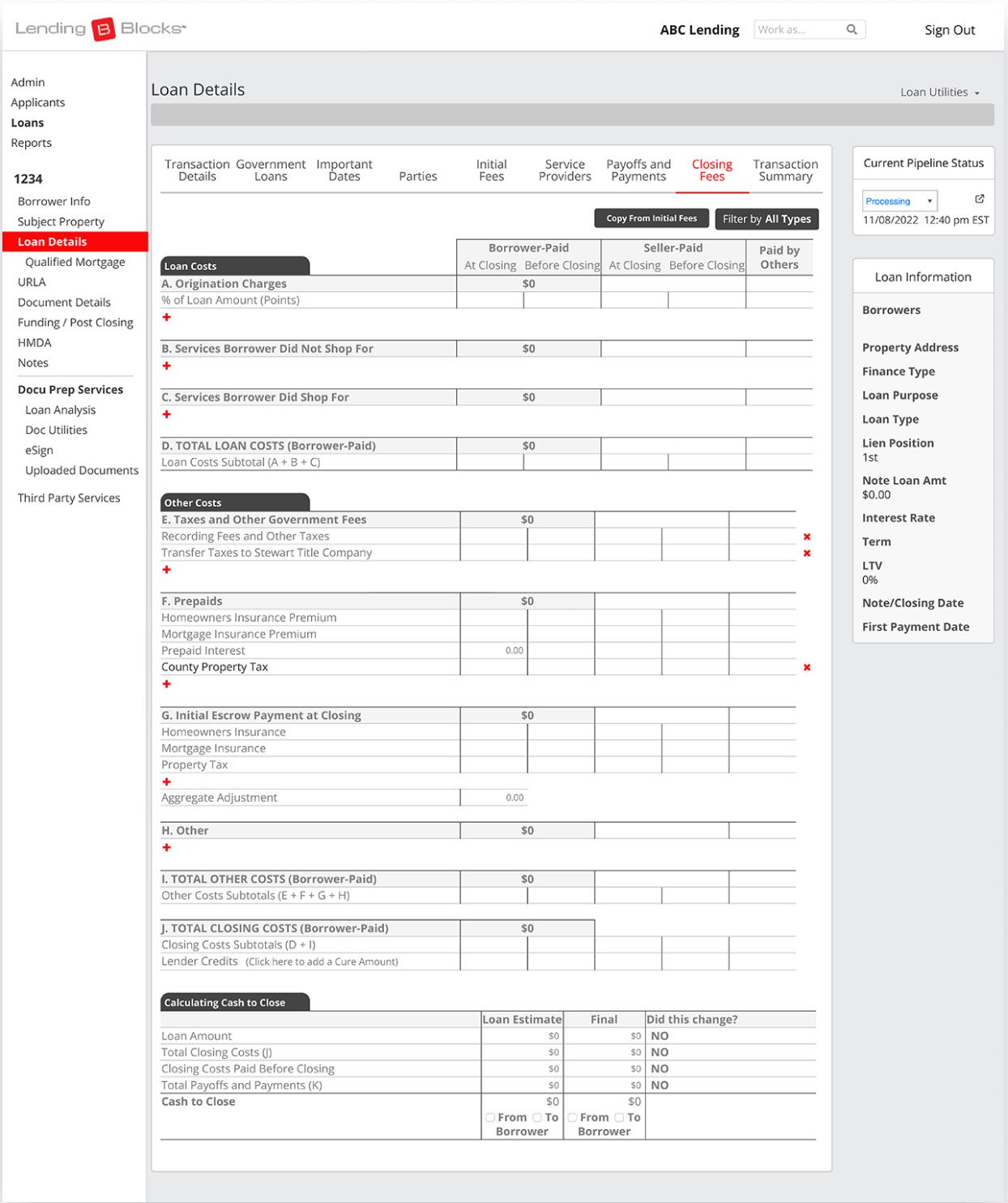

Docu Prep supplies a full array of documents to help manage and grow your lending business. Loan analysis tools provide the automatic benefit of fee review, appropriate warnings, and critical stop message notifications.

Reporting tools give you the vision and oversite you need to ensure loans are completed within the compliance requirements. It also helps us to say proactive as we support you in lending.

Compliant • Complete • Customized

Capture all the information that you need with your application or our online borrower application. Learn about it.

Learn MoreWe custom build the documents for your lending or you can use ours.

We maintain both federal and state regulations allowing the customer to have the highest degree of confidence in each document set.

Whether it’s a one-time close or a construction to permanent loan, we can handle your construction lending needs. If you have something outside of the box and need help figuring out the proper loan documents, let us help!

RV, Mobile Home, Consumer items, you name it and we can help with the documents you need. We are happy to build them to meet your specific needs.

We have docs for just about everything, but sometimes you need something built just for you. Our dynamic system is perfect for these special documents too!

A secure delivery, signing and reporting method that allows you to electronically sign documents. The paperless process is easy to use, saves time, money and meets state and federal guidelines. Request a Demo!

Learn MoreWhether it’s a HELOC or a HELOAN we can handle your document needs.

Finding the perfect balance of easy, accessible, and supported is what Hybrid closes are for. Quick when you need it, in person when you want it, but always easy!

We provide initial disclosures as well as re-disclosures ensuring compliance with federal, state and local statutes.

We understand that loan circumstances can change. That’s why we allow for free re-disclosures or re-draws on all our loans for up to six months.

Our mortgage, consumer, and custom lending lines of documents can help facilitate your process at all stages, including application, processing, closing and post-closing. This gives you a solution for all aspects of your business.

A powerful suite of productivity and compliance tools:

System integration is necessary as you move borrower information out of your Loan Origination System. We have connections with multiple LOS technologies. Integrations with these systems make getting the data into docs with little double checking and duplicate entry.

We focus on making lending easier and have built a Lending and Origination Solution with a “Tight Integration” to provide perfect transfer of lender’s and borrower’s information to document packages.

Docu Prep provides a full array of documents to help manage and grow your lending business.